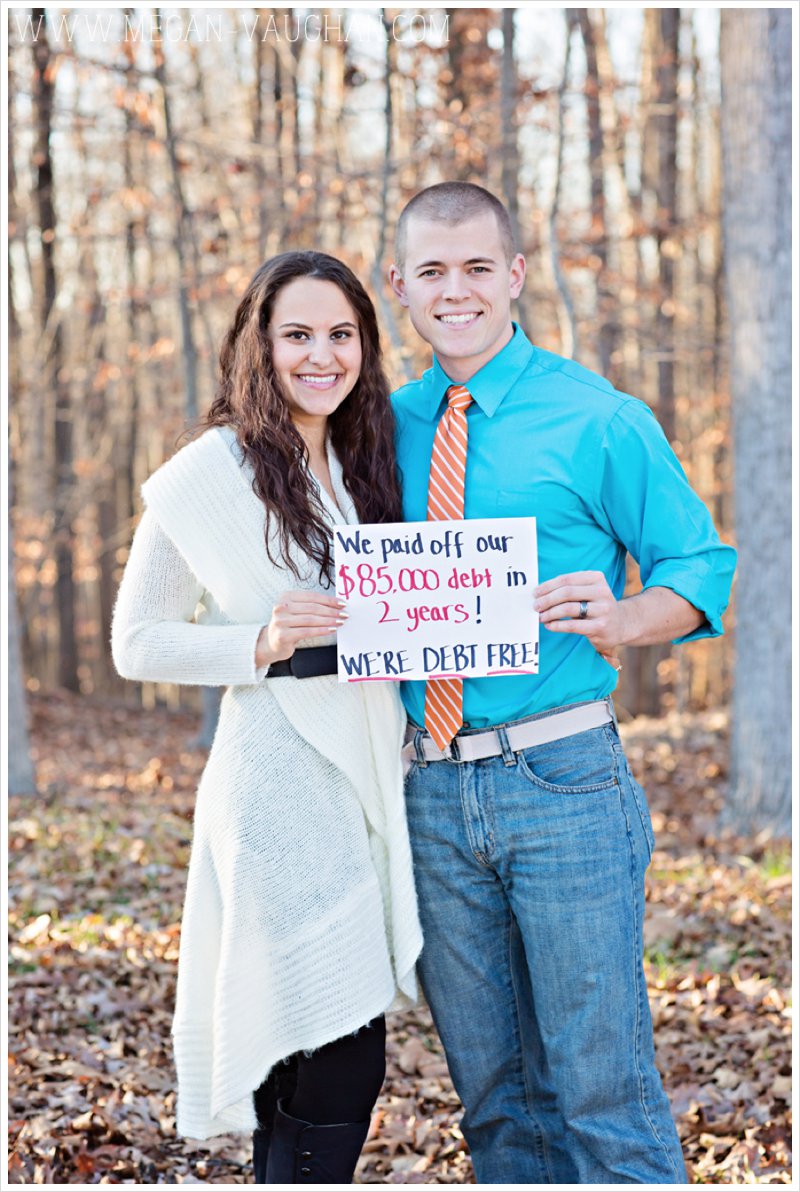

My husband, Mitch, and I began our marriage with $85,000 of debt. The number was suffocating and depressing. But it had to be paid off… and we did it! Here’s our story. 🙂

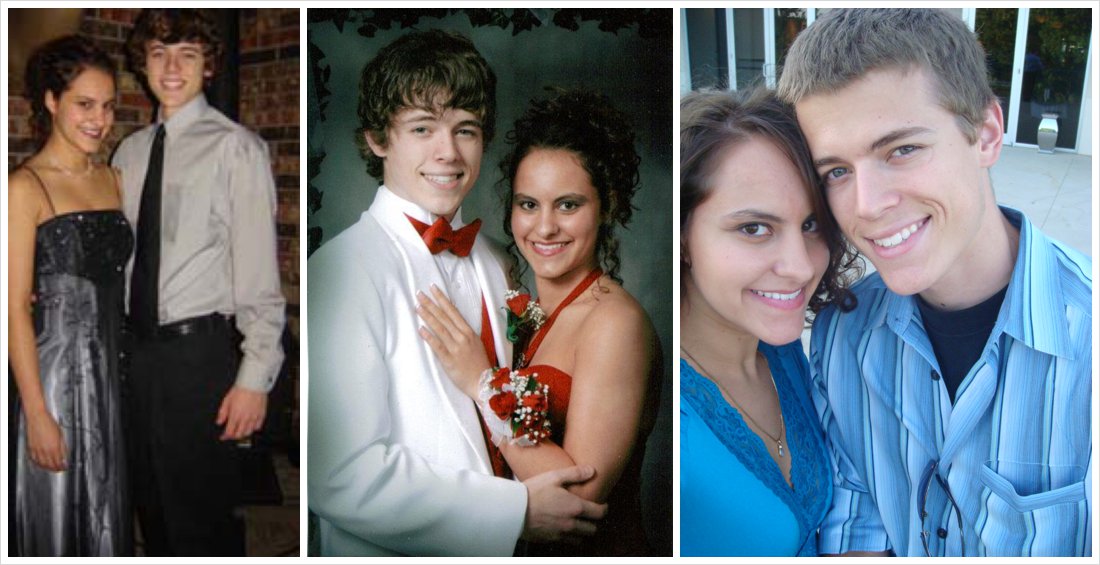

Mitch and I met when he was 14, I was 17. We dated for 5.5 years, all through his college career (I’ve got long distance relationship advice, too!) and in July of 2010 we finally got engaged. December 2010, Mitch was offered a job in Virginia. It took A LOT of prayer. We were going to be newlyweds, away from our parents and in a state where we knew no one. But we really felt like that’s where the Lord was leading us so we accepted the job. Jeremiah 29:11 (my favorite verse) says, ” For I know the plans I have for you,” declares the Lord, “plans to prosper you and not to harm you, plans to give you hope and a future.” We felt so much comfort from that verse.

Wedding images by Alex M.

We were married on June 11, 2011, and moved from Texas to Virginia right after we got back from the honeymoon. Within a month, Mitch graduated from college, we got married, honeymooned, came back and packed up our lives, moved across the country and Mitch started his ‘real world’ job, all within a month.

When we moved, Mitch had his job, but I didn’t have one. I taught for 2 years in Texas and did photography on the side (not full-time – not a reliable source of income. And especially with moving to a different state, I had to rebuild my client base from zero.) On the way to Virginia, I received a call for an interview for a teaching position. I interviewed the first week we got there, got the job and the summer ended with us knowing we would have two incomes. I also picked up a side business as an AdvoCare Distributor… that also helped make some supplemental income.

We followed what Dave Ramsey teaches in his Financial Peace series, which has been instrumental in helping us eliminate our debt. There were some things that he taught that didn’t apply to us (like having multiple credit cards that were maxed out)… and that’s ok! We took what applied to our lives and made it happen. We highly recommend going through Dave’s classes!

Set a budget and STICK TO IT. Mitch and I sat down and set our budget as soon as we merged our bank accounts together. We live by the rule that it’s OUR money… we don’t separate it. What I make is Mitch’s and what Mitch makes is mine. It’s all OURS. We established that every single extra cent we made would go to student loans. The thing that made a BIG difference for us, is that we set our budget based on Mitch’s income alone. My income was considered extra, which we split in half. Half to savings and half to student loans. We also budgeted a certain amount of Mitch’s income that went to savings and student loans, so we had savings and student loans being paid from two sources. We also tithe… every single month, no matter what our income is. Luke 6:38 – “Give, and it will be given to you. A good measure, pressed down, shaken together and running over, will be poured into your lap. For with the measure you use, it will be measured to you.” This is completely true for us.

It’s a good thing we budgeted that way. Long story short, I did not renew my teaching contract for 2012. Also, my photography business was at a stand still. We were back down to one income (and stayed that way for over a year), but because of the way we had budgeted, savings and student loans were still being paid and our lifestyle didn’t change.

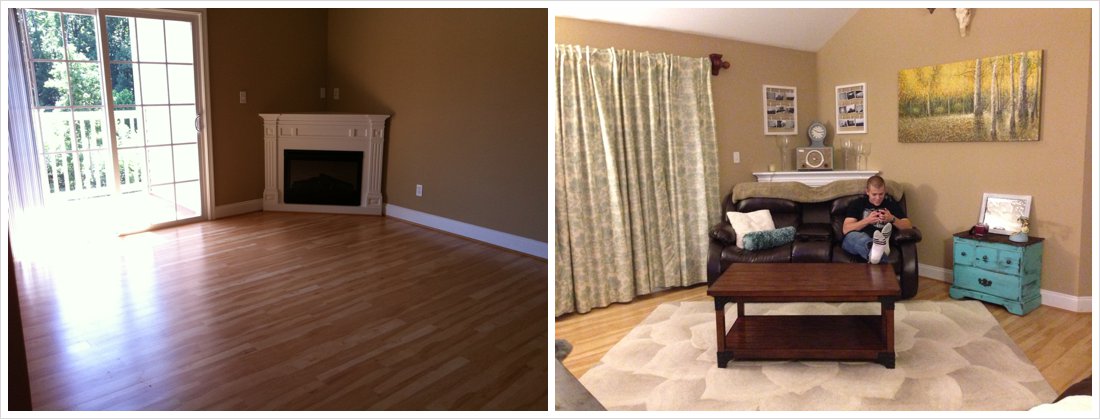

Take the 6 month grace period and SAVE. When you have students loans, the company who issued the note usually gives you a 6 month grace period. For 6 months after you graduate, you don’t have to pay anything. We took that grace period and SAVED. We saved every extra penny and slowly built our life. I had to be told SO many times that Rome wasn’t built in a day. I’m the kind of person who wants to nest, get every single thing we want for the house and put it all together in one day. Don’t do that. For the longest time, our couches were the only thing in our living room, we ate on a $10 card table from Target for months and said no to all the ‘big’ things we wanted. But now, 2.5 years into our marriage, we’ve built a cozy little home! Take your time to build your newlywed nest. It pays off in the long-run. Again, this may not work for you and you may want to get going right off the bat of those loans! Go for it! Saving for that 6 months was our personal decision.

When we first moved in and 2 years later. Rome wasn’t built in a day.

Seek wise counsel. Proverbs 1:5 says, “A wise man will hear and increase learning, and a man of understanding will attain wise counsel.” Present your financial situation to someone you trust who will give you wise, unbiased counsel, preferably someone who’s been married for a couple decades. I can’t tell you how many times we called Mitch’s parents. We also spoke with our financial advisor, Mike Randazzo, many times. We took their advice and applied it to our situation, which always led us down the right path.

As much as you want it, DO NOT buy the house! Again, I had to be told this so many times. You’re young, you’re newly married and you’re so in love. You want that perfect little house to begin your marriage with. Society says just buy the house. Don’t do it! Some people will tell you that renting is dumb because you’re throwing away money and you’ll never see it again. At least with a house, you’re paying towards something that’s yours. We chose not to go the house route. We rented, and at the middle of our price range. There was an apartment we found that I really, really liked but it was out of the budget, so we decided on something a little cheaper. In doing that, we’ve saved $7500 in rent alone. We also don’t pay for cable which has saved about $2500, among other things we’ve gone without and have saved on in the long-run.

Here’s our part of the story when it comes to buying a house, and where the importance of seeking wise counsel comes into play. In June of 2013, we got it in our heads that we were done with apartment living. We wanted a house. Period. We started looking, found one and I was ready to sign the contract right there. Mitch, on the other hand, felt uneasy and uncomfortable about it. Below is a picture of the house we were looking at.

We crunched numbers, tried to justify it with all the pros we could. The neighborhood, the house itself, the location, etc. We knew money was coming from here, we could sell this, we could do this and that. No conclusion we came to made Mitch feel better about it. And really, if we had to sit there and try to justify a purchase like that, we shouldn’t do it in the first place. Looking back at it now, deep down I knew I felt uneasy too. I was letting the idea of having a house get in the way of the goal… get the debt paid off.

We prayed and prayed and prayed. Didn’t feel any peace. We were on the phone multiple times with Mitch’s parents. They said no. We got on the phone with Mike and told him what we were thinking about doing. We gave him numbers, he listened to everything we had to say and he gave his advice: Don’t do it. Of course, I was crushed. I wanted to move so bad! Then he said this: There will be other houses. When the time is right, we’ll find the perfect house. He also said this, which was really the turning point for us: You can buy this house, have a mortgage and all the responsibilities that come with owning a house, live dangerously because our savings account was so low, and still having a 5-figure debt. OR, you can take your down payment, apply it to student loans, have a healthy amount in savings, be debt free in 6 months, save for another 6 months, and then buy a house stress-free. That advice really resonated with us. The minute we got off the phone with him, we took the money we were going to use for a down payment and put it towards student loans. We felt more peace about that decision that took less than one minute, then we did with our entire house searching/almost buying experience. Pulling out of the house was the best financial decision we made.

Every. Extra. Cent. In 2013 my photography business really took off. I had interviewed multiple times for different teaching positions but was denied each time, meanwhile my wedding bookings were skyrocketing! I really felt like the doors were being closed for teaching and opened to photography. Praying every step of the way, I turned my focus away from getting a teaching job and onto photography. I’m now able to call myself a ‘full-time’ photographer, but the income from that is not included in our budget. Again, our budget is built from Mitch’s income alone.

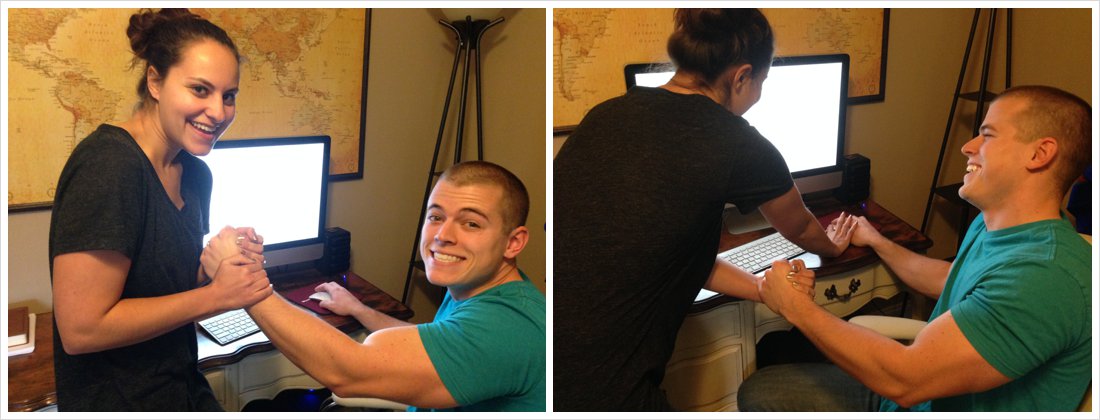

Making the FINAL PAYMENT!!!

Freedom. Now, 2 years of marriage later, we’ve paid off our $85,000 debt. We are officially debt free!! Did we sacrifice things we wanted, whether it be the coolest, newest gadgets, the fancy cars (we actually shopped for cars 3 different times in that 2 years, always saying no each time), the huge house, the pretty clothes, etc? Yes, we did. Was it worth it? Absolutely. From here, we will put the money that would have been put to student loans into an account where we will begin to save for a real down payment, and NOT take it from our savings account. And of course, we will be celebrating appropriately!

Dave Ramsey says, “Live like no one does now, so you can live like no one does later.” That’s the motto we’ve been chanting in our heads the past two years. Lately, it’s been ‘debt free by December’ and we’ve accomplished that! We’ll be buying a house and starting a family with zero debt. Of course we can’t pay for those things in full, but at least we won’t have tens of thousands of dollars in loans to add on to!

Your situation is probably completely different and what worked for us may not work for you… and that’s ok! We are not financial advisors and do not claim to know everything there is to know about paying off debt. We want to encourage, inspire and show you that YES, paying off your debt is 100% possible. You don’t have to resign yourself to being in debt your whole life! Make your plan, set your budget and FOLLOW IT!

If you have questions about your financial situation, give Dave Ramsey a call!

We give all the glory to God. Without Him and His relentless, abundant blessings, we wouldn’t be where we are now. Go Jesus!

—————————–

UPDATE! August 2014

The hunt for our first home continues! We’re continuing to save as much money as possible to use for a down payment. We’ve looked at many houses… a couple we totally loved! But the asking price was too high. We ran the numbers and did not want to be paying $2000 a month for a mortgage. We don’t want to be house poor. So we’ve said no and continued the search. We know that God will show us the house in His time.

UPDATE! November 2014

The hunt continues on! Mitch has been gone for work and it’s difficult to house hunt without your better half! We’ve been saving for about a year now for our down payment. While we could afford a larger, nicer house, we’ve decided to find something we can update to make our own. During our time in that house, we want to continue to save as much as we can and pay off the house. Within 4-5 years, combined with selling our house and our savings, we hope to build our DREAM HOME! We’ve already found the plans we want!

UPDATE! March 2015

WE HAVE FOUND OUR HOUSE!!!! We’ve put an offer on it, it’s been accepted and we close at the end of the month! WEEEE GOD IS SO GOOD!!

UPDATE! April 2015

WE ARE OFFICIALLY HOMEOWNERS!!!!! We will move in in June.

UPDATE! July 2015

The Lord is so good. We are expecting our first child in February! It’s amazing to go through this journey knowing those student loans are paid off! Our only debt is the house… which we’re working on!

UPDATE! April 2016

We’ve made a TON of updates to our new home. Each time, we plan, budget for it and pay in full. Also, our son is 3 months old! We’re working on paying off our mortgage like we did our student loan debt. Gold star for adulting!

UPDATE! January 2018

We are currently saving to buy a new car in cash!

UPDATE! June 2019

Our son is 3 and our daughter is 6 months old! We figured out a car payment could be a write off and it’s helped tremendously with taxes. Our greenhouse has paid for itself less than a year after opening it to the public. We’re currently adding a deck onto our house that has also been paid for!